Picture this: you run a homeless shelter, and you’re always coming up with innovative ways to fundraise so you can provide your residents with everything they need, including food, clothing, blankets, and personal care items.

While it’s important for your organization to solicit monetary donations and maintain a regular flow of cash, you could also benefit from in-kind donations. Receiving some items directly from your donors reduces the need for your organization to procure them, freeing up time and resources for other initiatives.

To jumpstart your in-kind donation collection efforts, we’ll review everything you need to know, including:

- What Is an In-Kind Donation?

- In-Kind Donation Types

- Benefits of In-Kind Donations

- Creating a Gift Acceptance Policy

- How and When to Record and Report In-Kind Donations

- 6 Strategies for Soliciting In-Kind Donations

Once you understand exactly what an in-kind donation is, its benefits, and how to best solicit, record, and report on them, you’ll be all set to start collecting these contributions for your beneficiaries.

Want help managing your in‑kind donations?

What Is an In-Kind Donation?

An in-kind donation is a nonfinancial donation, typically of goods or services. In-kind donations allow nonprofits to access goods and services that they may not be able to afford to purchase.

As a result, they can free up resources they’d typically spend on those items and reallocate them to other areas of their budget. For example, let’s say an animal shelter typically spends $500 per week on pet food. If donors contribute in-kind donations that total a month’s worth of pet food, then the shelter would have $2,000 of extra funds that they could spend on other expenses.

This opportunity also encourages businesses to contribute to nonprofits since they may be more willing to contribute items than cash. Consequently, businesses and nonprofits can forge impactful partnerships that push both of their goals forward.

In-Kind Donation Types

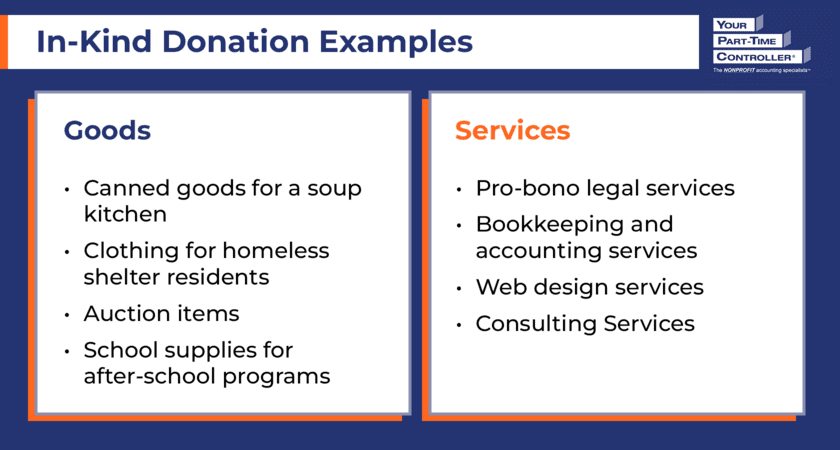

There are two main types of in-kind donations: goods and services. We’ll review what each type entails and give a few examples.

Goods

When you picture an in-kind donation, you’re most likely thinking of a contribution of goods. Goods are donated materials or assets (usually physical items) that your nonprofit can benefit from. Common examples of goods nonprofits may receive include:

- Canned goods for a soup kitchen

- Clothing for homeless shelter residents

- Auction items

- School supplies for after-school programs

Organizations can either use these assets in their programs or sell them for cash to fund their activities.

Services

It’s possible that instead of an item, a donor contributes their time or expertise to your nonprofit. That way, your nonprofit doesn’t have to pay for this service as they normally would, which can be especially helpful for new nonprofits or organizations on a tight budget. Services an individual or organization may donate include:

- Pro-bono legal services

- Bookkeeping and accounting services

- Web design services

- Consulting services

While mid-sized to larger nonprofits may outsource these services, smaller nonprofits may seek out community members willing to donate their time and expertise until they have the resources to pay professionals.

Other

In addition to goods and services, your nonprofit might also receive in-kind donations of:

For instance, it’s common for nonprofits to receive free use of office space as an in-kind donation.

Benefits of In-Kind Donations

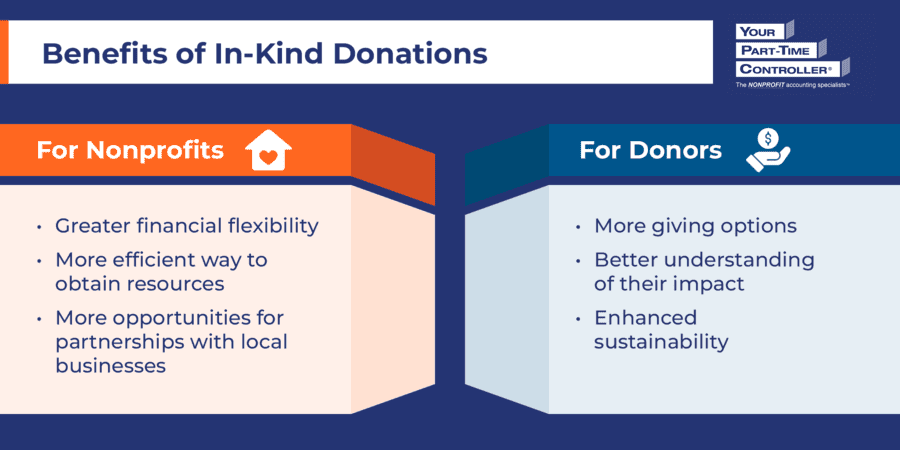

When your nonprofit secures in-kind donations, you receive greater benefits beyond the items themselves. These benefits include:

- Greater financial flexibility. As mentioned previously, in-kind donations allow you to reallocate the funds you would have spent on those goods or services to other areas of your budget.

- More efficient way to obtain resources. While you would typically have to order these materials and wait for them to arrive, in-kind donations allow you to access the items you need right away. Plus, you don’t have to get leadership approval as you normally would to purchase these resources, speeding up the process of putting these items to use. Alternatively, you can sell donated items your organization doesn’t need for cash, which is common for donations of personal property such as equipment and automobiles.

- More opportunities for partnerships with local businesses. Accepting in-kind donations opens up the possibility that local businesses will contribute to your nonprofit. You can work with these organizations to provide for your beneficiaries, host events, and promote your mission to the broader community.

Additionally, in-kind donations benefit the donors who contribute them. These advantages include:

- More giving options. When you accept in-kind donations, you give donors who may not have available funds the chance to contribute. In fact, 81% of donors give to nonprofits through in-kind donations, indicating the popularity of this giving method. Donors who contribute in-kind donations of property (services not included) may even be able to deduct their gifts on their tax returns—just like they can for cash donations.

- Better understanding of their impact. While it can be difficult to report back to donors where their exact dollars have gone to fund your mission, it’s much easier to explain the impact of donors’ tangible contributions of goods or services.

- Enhanced sustainability. Donors who contribute items they don’t use instead of throwing them away can be proud of their positive impact on the environment.

While monetary donations are always useful for nonprofits, in-kind donations diversify the support you receive, allowing you to reduce your reliance on cash donations and provide unique opportunities for donors to contribute.

Creating a Gift Acceptance Policy

The largest challenge of accepting in-kind donations is that sometimes nonprofits receive items they can’t use. These may include expired items, broken or damaged goods, items with legal restrictions, or hazardous materials.

To combat this issue, your nonprofit should create a comprehensive gift acceptance policy and ensure donors know where they can reference it. This policy should include:

- The types of gifts your organization can and can’t accept

- The circumstances under which you’ll accept different types of gifts

- The process of recording each type of gift

These types of policies not only help donors determine whether their gift will be accepted, but they also allow nonprofits to politely decline gifts by referencing the policy. It’s much easier (and kinder) to tell your donors, “Thank you so much for your contribution. Unfortunately, this donation violates our gift acceptance policy, so we regretfully won’t be able to accept it,” than to simply turn them away.

Additionally, promoting your gift acceptance policy can inspire donors who have eligible items on hand to contribute. For instance, a soup kitchen may create a social media post highlighting items that are currently in demand and attach its in-kind donation policy. Upon seeing the post, a donor may go through their pantry to find non-expired canned goods and drop them off at the soup kitchen’s headquarters the next day.

How and When to Record and Report In-Kind Donations

Once you receive in-kind donations, you’ll have to record them in your accounting system and report them for tax purposes. According to Generally Accepted Accounting Principles (GAAP), nonprofits must keep thorough records of all monetary and in-kind donations. These records will also help prepare your organization for future financial audits.

However, an in-kind donation must meet specific requirements for recognition within its financial reports. For example, donations of services are recognized if they create or enhance nonfinancial assets (such as a group of parents getting together to build a storage garage behind a nonprofit’s office) or are provided by individuals possessing specialized skills (such as professionals and craftsmen) and would typically need to be purchased if not donated. Thus, while valuable to helping a soup kitchen meet its mission, the services of volunteers who work the food line for Thanksgiving dinner would not meet the requirements for recognition in the entity’s financial reports, for example.

It’s required that nonprofits report in-kind donations separately within their financial statements. This means you should record in-kind donations in a separate revenue account within your chart of accounts.

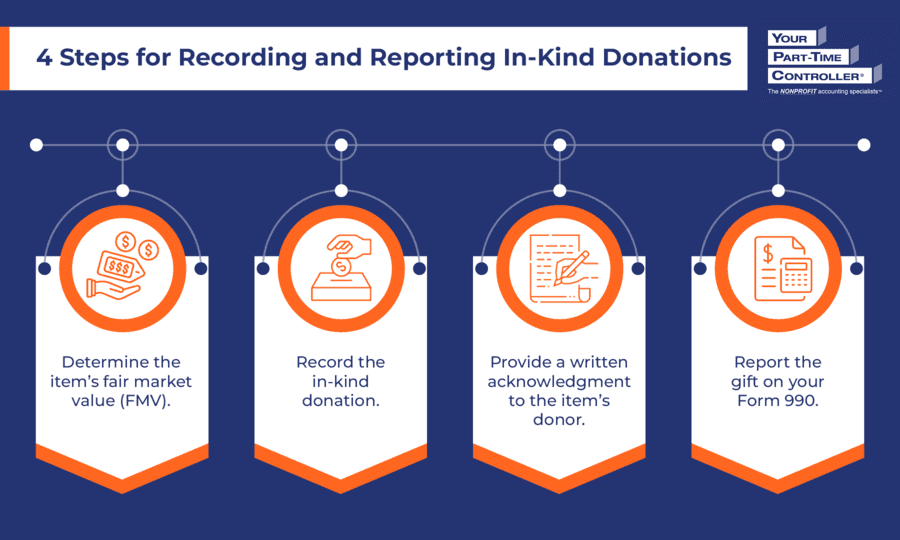

After determining whether an in-kind donation meets the requirements for recognition, follow these steps to properly record and report the contribution:

1. Determine the item’s fair market value (FMV).

Fair market value (FMV) refers to the price you would typically pay for a good or service on the open market. You should record gifts-in-kind at their fair market value when you receive them. For auctions, record donated auction items at fair value when you receive the gifts, and adjust the value up or down based on the amount received when sold at auction.

Depending on the item you’re evaluating, there are several different ways to determine FMV:

- If the item has a straightforward value, use that as the FMV. For instance, a clothing item you receive may still have a price tag on it, or you may be able to find the value of a canned good by looking at your local grocery store’s website. Items may depreciate over time, though, so turn to your accountant for advice if you’re unsure how to value a contribution.

- If the item is one-of-a-kind, like custom artwork or signed celebrity memorabilia you plan to sell at an auction, check with the item’s provider. However, be aware that owners may overvalue their own possessions, especially if they have sentimental value. Always verify the owner’s estimate by looking for comparable items for sale online.

- If it’s a donation of services, ask the provider how much they would typically charge for a similar project. Alternatively, you can calculate the value of their service by multiplying their hourly rate by how many hours they’ve spent working with your organization.

2. Record the in-kind donation.

As mentioned above, you’ll record your in-kind donation in a separate revenue account within your chart of accounts. In general, in-kind donations will have no impact on your entity’s net income because you’ll record the value of the donation as both a revenue and expense item.

For instance, let’s say that your organization has received $500 worth of pro bono legal services from a local attorney. Your entity would recognize both revenue and expense for the legal services contributed.

3. Provide a written acknowledgment to the item’s donor.

In-kind donations of property are typically tax deductible, but the IRS will not allow taxpayers to deduct contributions of $250 or more unless they obtain a written acknowledgment from the recipient charitable organization. It’s important to note that the IRS does not allow taxpayers to deduct the value of time or services.

The written acknowledgment should include:

- Your nonprofit’s name and employer identification number (EIN)

- The date you received the property or the service was completed

- A description of the property received

- A statement that no goods or services were provided in return for the contribution (If you did provide goods or services in return for the contribution, include a description and good faith estimate of the fair market value of the goods or services.)

For a more in-depth overview of acknowledgment requirements, refer to Publication 1771, Charitable Contributions: Substantiation and Disclosure Requirements from the IRS.

Legally, your nonprofit can’t provide the value of the donation to the donor—they’ll need to fill that in themselves when they prepare their tax returns. However, you can (and should) assure them of the impact of their contribution and show your appreciation for their gift.

4. Report the gift on your Form 990.

Form 990 annual information returns require nonprofits to report all noncash contributions as part of their total revenue for the year. While you’ll report donations of property and goods, gifts of services and use of facilities are not included in the revenue section but are reported as a reconciling item at the end of the form.

Additionally, there are a few types of in-kind donations the IRS requires additional paperwork for, including:

- Items worth over $25,000

- Historical artifacts or artwork

- Donations worth $500 or more, such as vehicles

There may also be additional reporting requirements depending on your state of operation, so be sure to check for relevant guidelines so your nonprofit can maintain compliance.

6 Strategies for Soliciting In-Kind Donations

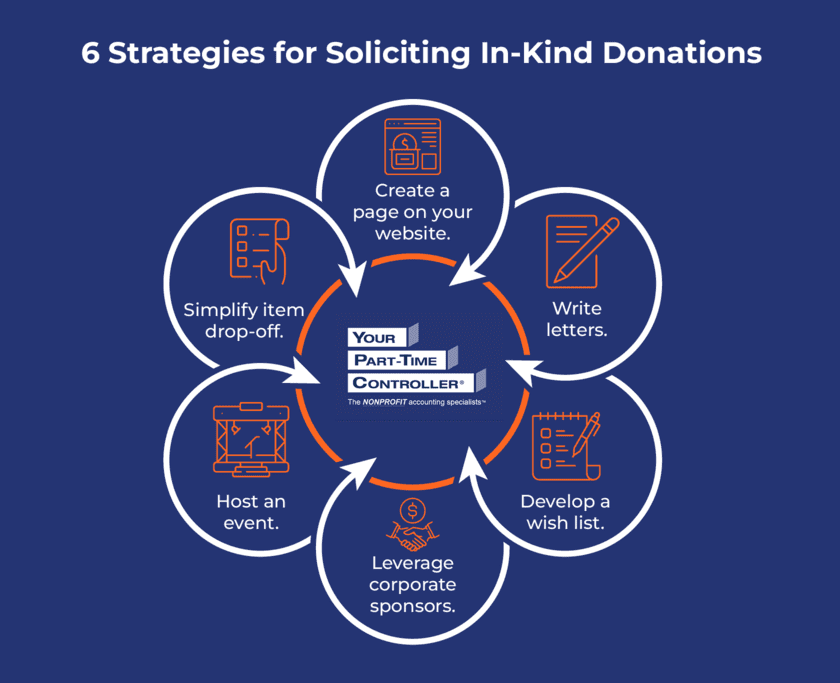

Now that you’re prepared to record and report in-kind donations, it’s time to begin soliciting them! To help you get started, we’ve compiled several strategies for encouraging and collecting in-kind contributions:

- Create an in-kind donations page on your website. To let donors know what items your organization needs and how to drop them off, compile that information on an in-kind donations page on your website. You can also feature your gift acceptance policy there for easy access.

- Write letters to potential in-kind donors. If you’ve solicited major monetary gifts in the past, you know that personalization is key, and the same is true with large in-kind donations. Try combing through your donor database for potential in-kind donors, and write your donation request as a tailored letter. For instance, you may identify the owner of a technology company amongst your donors and ask if they’d be willing to contribute some equipment.

- Develop a wish list of desired items. Let your supporters know exactly which items you need with a dedicated wish list. Just as individuals create Amazon wish lists of items they’d like to own, your nonprofit can create a similar list and share it with your donor base. That way, you maximize the chances of receiving useful items that align with your gift acceptance policy and your donors’ budgets.

- Leverage corporate sponsor relationships. If you’ve already partnered with a business in the past, try reaching out to them again to see if they’d be willing to donate goods or services to your organization. Emphasize that in-kind donations are a great opportunity for them to boost their reputation as socially responsible companies and contribute to your nonprofit non-monetarily.

- Host an event. Bring your nonprofit’s community together with an event that promotes in-kind donations. For instance, a food or clothing drive allows you to focus on collecting in-kind contributions over an extended period of time.

- Make it easy for donors to drop off their items. Once you’ve successfully solicited an in-kind donation, make sure it’s easy for donors to drop off their contributions. Provide multiple donation sites if possible so donors can choose the one that is most convenient for them. Alternatively, you may offer to pick items up from donors, especially if they’re difficult for them to transport.

The more clearly you communicate to donors which items you need and how to drop them off, the more likely you are to receive useful, eligible contributions in a timely manner.

Wrapping Up

With an in-depth understanding of in-kind donations and how they can help your organization, you’ve likely already started thinking about which items your nonprofit could most benefit from. Finalize this list with your team, and promote it to your supporters, along with your gift acceptance policy.

While we’ve reviewed how your organization can properly record and report your in-kind donations, take the stress out of this process by leaving it up to professionals. The nonprofit accountants at YPTC are equipped to assist you with your in-kind donation recording and reporting needs.

For more information about nonprofit financial management, check out the following resources:

- Nonprofit Accounting: What Charitable Orgs Need to Know. Learn the ins and outs of nonprofit accounting in this complete guide.

- Nonprofit Budgeting Tips That Count! Featuring Justine Townsend. Follow along with YPTC Manager Justine Townsend as she provides tips for how to improve your nonprofit’s budgeting processes.

- What We Do. Curious about how we can support your nonprofit beyond recording and reporting your in-kind donations? Check out all of our nonprofit accounting and bookkeeping services.

Once you’ve solicited in-kind donations, leave the rest to us.

The accountants at YPTC can record and report these contributions for you.