How to Fill Out Form W-9 for Nonprofit Orgs: FAQs + 8 Steps

When you start a nonprofit, you might not expect to spend a lot of time on tax-related forms, given your tax-exempt status. Then you find out, being a tax-exempt organization doesn’t exempt you from all taxation, nor does it exempt you from informational return filings.

Luckily, the W-9, for nonprofit organizations, is a simple form to complete, allowing you to easily check off at least one IRS form from your to-do list. To streamline the process even further, we’ll answer the following questions:

- Frequently Asked Questions About the Basics of Form W-9 for Nonprofits

- Frequently Asked Questions About Completing W-9 for Nonprofits

- What if I need help with other aspects of nonprofit financial management?

Once you learn the ins and outs of Form W-9, you’ll be well-equipped to compile and process this form efficiently and move on to more mission-critical tasks more quickly.

Frequently Asked Questions About the Basics of Form W-9 for Nonprofits

What is a W-9 for nonprofit organizations?

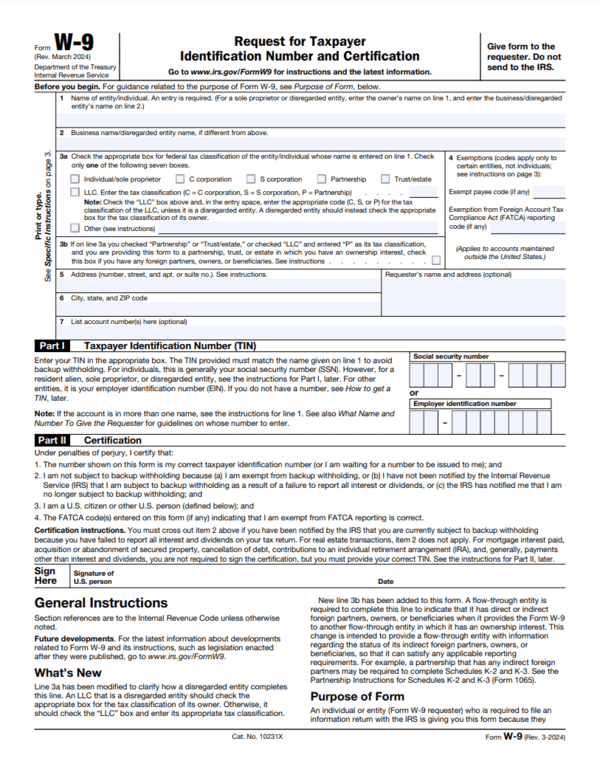

IRS Form W-9, also known as the “Request for Taxpayer Identification Number and Certification,” is a form used to collect a contractor’s Tax Identification Number (TIN) and other necessary tax information. Form W-9 is not specific to nonprofits—it is used by all types of entities.

The official form is six pages long, but the taxpayer only has to fill out the front page. The remaining five pages are instructions for completing the form. Here is what the first page looks like:

In addition to the contractor’s TIN, this form also collects information like the contractor’s:

- Name

- Type of entity

- Mailing address

Ultimately, Form W-9 provides the information the contracting organization needs to fill out Form 1099, which reports on the non-employee compensation and miscellaneous income organizations pay to consultants, contractors, freelancers, and other vendors. Form 1099 helps the IRS ensure that taxpayers are reporting all their income from various sources, including contracted work, rent, royalties, and other non-employee compensation.

When does my nonprofit have to request or fill out Form W-9?

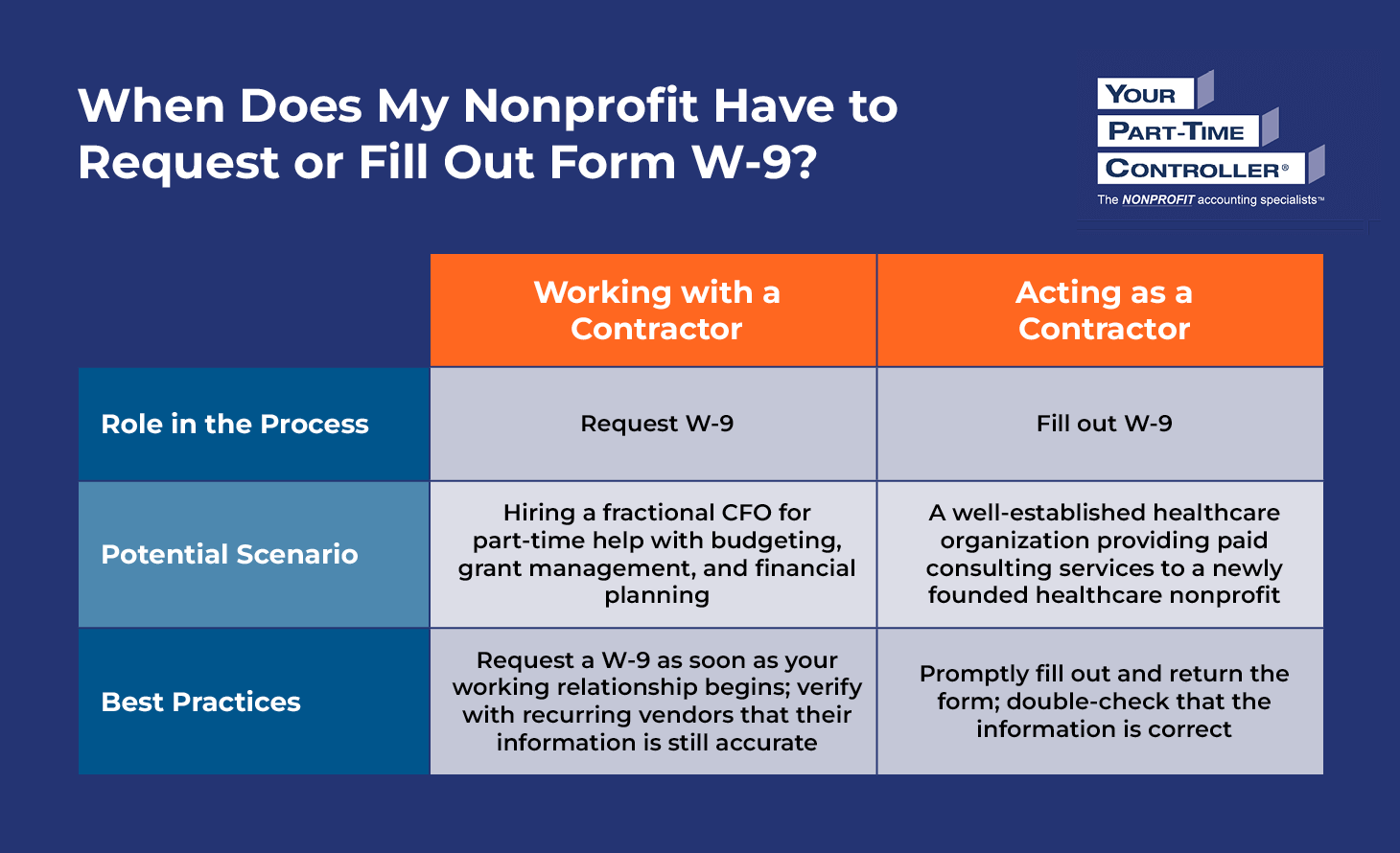

There are two possible instances in which your nonprofit would need to handle Form W-9: when you work with a contractor or act as a contractor for another organization. Here’s what your nonprofit’s role looks like in each of these scenarios:

1. You work with a contractor.

When you hire an outside vendor or contractor, you need to request a W-9 from them. You’ll gain access to information like their TIN and mailing address, which you can include (alongside the income you’ve paid them) on Form 1099, if the following conditions apply:

- You’re paying an independent party who is not your nonprofit’s employee.

- The recipient is a non-employee individual, sole proprietor, or LLC that’s not organized as a C- or S-type corporation. Note: There are exceptions in which certain corporations must receive a 1099 (e.g., corporations receiving payments for legal, medical, or healthcare services).

- The individual performed services for your organization (Form 1099-NEC) OR received miscellaneous income, such as rent paid directly to property owners, gross proceeds paid to attorneys, royalties, prizes, or payments to physicians or medical service providers (Form 1099-MISC).

- You paid this individual at least $2,000 (for years 2026 and later; previously, the threshold was $600) or at least $10 in royalties within the calendar year.

For example, let’s say you hire a fractional CFO for part-time budgeting, grant management, and financial planning assistance. If you’re working with this contractor for the first time, you should request a W-9 from them as soon as possible once your working relationship begins. That way, you can ensure you have the information you need to properly report your payments and avoid scrambling for these details when Form 1099 is due.

For more help determining if you need to request a W-9, use our interactive decision tree below:

2. You act as a contractor for another organization.

Although it’s less common, there may be some situations in which your nonprofit takes on the role of a contractor. For example, if you run a well-established healthcare organization, you may provide paid consulting services to a newly founded healthcare nonprofit to get them up and running and pass on industry knowledge.

Even though tax-exempt organizations are technically excluded from 1099 reporting, the new nonprofit may still request a W-9 from your organization as they do for all vendors. When requested, you should fill out Form W-9 and return it promptly. They may or may not issue you a 1099, and even if they do, receiving a 1099 does not determine taxability of the reported income.

No matter which side of the contractual relationship your nonprofit is on, you should be familiar with Form W-9 to expedite the process of compiling, processing, and providing this form.

Do we need a new W-9 from each vendor every year?

If you’ve already worked with a contractor before, you can continue using the original W-9 you requested from them. However, it’s good practice to verify each year with your vendors and contractors that the information they’ve provided is still accurate. For example, if their address or TIN changes, you’ll need to request a new W-9.

How long should we keep our W-9s on file?

The IRS recommends keeping Form W-9 for four years. That way, if the IRS has any inquiries regarding independent contractor payments, you have the documentation to answer their questions.

What happens if a contractor refuses to give our nonprofit a W-9?

If a contractor refuses to provide a W-9, document your communications so you can prove to the IRS that you attempted to acquire one. If the contractor fails to provide you with a TIN or provides an incorrect TIN for 1099 reporting, the IRS requires backup withholding (24% of reportable non-employee compensation payments).

Do the new tax bill changes affect when we need a W-9?

No. The new tax bill changes the threshold for reportable payments on Form 1099 from $600 to $2,000 for the 2026 tax year. However, you should still request a W-9 from every vendor to have their information on file, especially because you may not always know at the beginning of the year if the total you pay them will exceed the threshold.

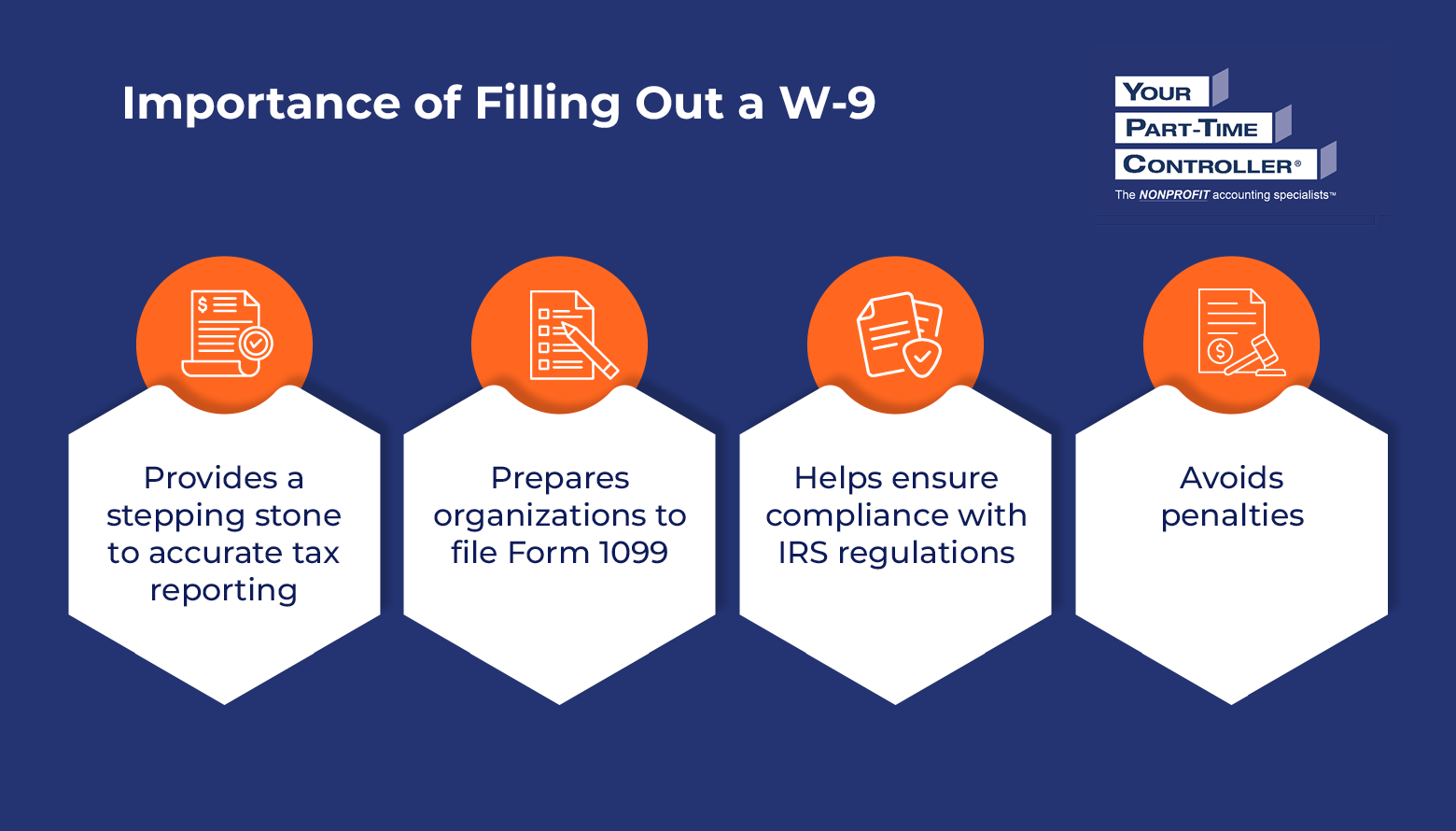

Why is it so important to fill out a W-9?

While Form W-9 itself never reaches the IRS, it’s a stepping stone to tax compliance. This form provides information necessary to prepare and file Form 1099.

If an organization fails to file Form 1099 correctly or on time (the deadline is January 31), IRS penalties may apply.

If your organization won’t be able to file Form 1099 on time, you may be able to request an extension by submitting Form 8809 to the IRS. However, the IRS does not automatically grant extensions for Form 1099—which is why filling out Form W-9 and Form 1099 promptly is so important!

What are some common W-9 mistakes to avoid?

Common W-9 mistakes to avoid include:

- Using the wrong TIN

- Waiting until after payment to request a W-9

- Failing to update the W-9 you have on file when a vendor’s information changes

Frequently Asked Questions About Completing W-9 for Nonprofits

How do you fill out Form W-9 for nonprofit organizations?

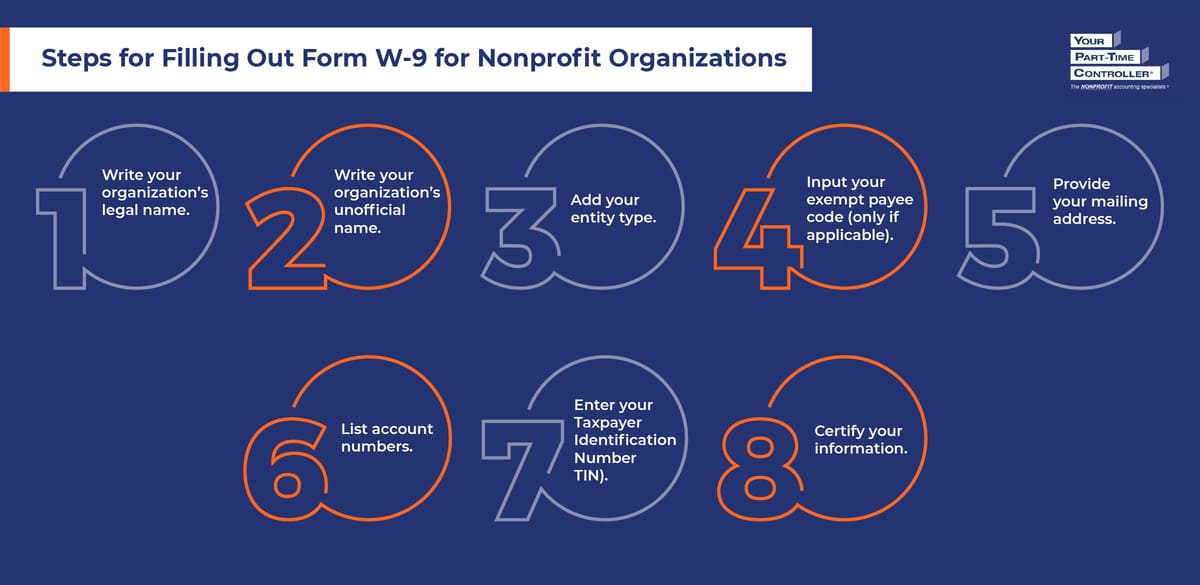

To get started with the W-9 process, locate the appropriate form on the IRS website. Then, follow these steps.

1. Write your organization’s legal name.

In Box 1, write your organization’s legal or official name. This should be the exact name you used on Form 1023, Form 1024, or Form 1024A to become a tax-exempt organization, your articles of incorporation, and your Form 990.

2. Write your organization’s unofficial name.

You and your constituents may use an unofficial or assumed name to refer to your nonprofit that’s different from your organization’s legal name. If that’s the case, use Box 2 to enter your organization’s unofficial name.

For example, your organization’s legal name may be “Save the Trees, Please Inc.” while your unofficial name would simply be “Save the Trees, Please.” In this case, you would write “Save the Trees, Please Inc.” in Box 1 and “Save the Trees, Please” in Box 2.

3. Add your entity type.

Box 3 is where you’ll include your nonprofit’s federal tax classification or entity type. The options for this section include:

- Individual/sole proprietor

- C Corporation

- S Corporation

- Partnership

- Trust/estate

- Limited liability company (LLC) with C corporation, S corporation, or partnership tax classification

- Other

If your nonprofit is a corporation, you can check the “C Corporation” box. Alternatively, any nonprofit can check “Other” and fill in their organization’s legal classification. If you’re unsure about your organization’s classification, reach out to your accountant or attorney with any questions.

4. Input your exempt payee code (only if applicable).

Box 4 allows you to claim an exemption from backup withholding and FATCA reporting in certain situations, most of which don’t apply to charitable nonprofits.

Therefore, most nonprofits will leave Box 4 blank. However, you should double-check the requirements in the instructions to ensure you complete this box as appropriate for your situation, and consult with your tax or legal advisor if you have questions.

5. Provide your mailing address.

In Box 5, provide your organization’s street number, street name, and apartment or suite number (if applicable). Then, in Box 6, you’ll complete your mailing address with your city, state, and ZIP code.

There is also a box next to these two boxes that gives you the option to enter the requester’s name and address. While optional, filling out this information allows you to keep track of the organizations that have access to your TIN, verify the entity or individual requesting the form, and ensure you can easily get in contact with them via mail if necessary.

6. List account numbers.

You may use Box 7 to list account numbers that may help the requesting entity identify you. This box is optional, so if you don’t have an account number with the requester or they haven’t asked you to include one, feel free to leave it blank.

7. Enter your Taxpayer Identification Number (TIN).

While individual contractors use their Social Security numbers as their Taxpayer Identification Numbers (TIN), all registered nonprofit organizations should have unique employer identification numbers (EINs) issued by the IRS. Include this information in the section labeled “Part I,” and leave the Social Security box empty.

If you still have to apply for an EIN or are in the process of doing so, make sure to file Form SS-4 as soon as possible. Then, write “Applied For” in the TIN box. From this point, you’ll have 60 days to provide your EIN to the requesting organization.

8. Certify your information.

Lastly, you’ll sign and date the form in the “Part II” section to certify that:

- Your TIN is correctly stated.

- You are not subject to backup withholding, which would require you to send a portion of your payment to the IRS.

- You are a U.S. citizen or other U.S. person.

- Any Foreign Account Tax Compliance Act (FATCA) codes you’ve entered are correct.

Double-check that all the information you’ve included is correct so you can confidently sign, date, and submit the form.

How do you close out the Form W-9 process?

Determining your next steps for submitting Form W-9 depends on whether you’re requesting the form or receiving it from another entity:

- If your organization requests the form from a contractor, make sure it’s clear whether you’d like to receive the form via mail, email, fax, or an online document service. You’ll use Form W-9 to complete Form 1099 by the January 31st deadline. In addition to the contractor’s name, address, and TIN, you’ll also need to pull information from your records, including the category of payments you paid to the contractor, tax withholding information, and their total non-employee compensation.

- If a contracting organization requests the form from your organization, it’s your responsibility to fill out the W-9 and return it to the requester as soon as possible. Unless you have to apply for an EIN, it shouldn’t take you too long to fill out this form. Aim to get it back to the contracting organization in a timely manner.

Since these forms contain sensitive information, remember to store them securely, and always use a secure file transfer link or a password-protected PDF to share them. Some software will also help to keep all of your forms organized so you can easily access and reference them as needed.

What if I need help with other aspects of nonprofit financial management?

Although the W-9 is simple to collect and straightforward to complete, it’s essential that you take the time to ensure all the information you receive or enter is accurate. Follow the steps in this guide to ensure you do a thorough job and collect or include everything needed for the W-9/1099 process.

If you require any other financial management assistance, the accounting specialists at YPTC are here to help. That way, you can reserve your time for more mission-critical work and be confident you’re managing your finances correctly. Contact us today to learn more about how we can tackle your organization’s accounting or bookkeeping needs.

If your nonprofit wants to learn more about nonprofit accounting and finances, check out these additional resources:

- Do Nonprofits Get a 1099? How to Receive & Issue This Form. Once you’ve collected Form W-9, you’ll use it to fill out Form 1099. Learn how in this step-by-step guide.

- Nonprofit Accounting: What Charitable Orgs Need to Know. Want to learn the ins and outs of nonprofit accounting? Look no further than this ultimate guide.

- Demystifying Nonprofit Financial Statements: Complete Guide. Do you know the four main nonprofit financial statements your organization should compile? Dive into these important documents today.

Jennifer Alleva

Jennifer Alleva is the Chief Executive Officer at Your Part-Time Controller, LLC (YPTC), a leading provider of nonprofit accounting services and #65 on Accounting Today’s list of Top 100 accounting firms. Jennifer brings over three decades of expertise in accounting and leadership to her role as CEO of YPTC.

When Jennifer joined YPTC in 2003, the firm consisted of just over 10 staff members. Since then, she has helped grow YPTC into one of the fastest-growing accounting firms in the country.

Jennifer’s accomplishments include her tenure as an adjunct professor at the University of Pennsylvania Fels Institute, her frequent speaking engagements on nonprofit financial management issues, her role as the founder of the Women in Nonprofit Leadership Conference in Philadelphia, and her launch of the Mission Business Podcast in 2021, which spotlights professionals and narratives from the nonprofit sector.