What Is a Nonprofit Controller? Clarifying This Crucial Role

Updated On: 01/28/2026

Imagine you run a foundation that funds research on a rare disease. Between soliciting major donors, planning your upcoming annual gala, and leading your board, you have your hands full.

On top of all these tasks, you must manage your nonprofit’s finances to ensure you properly allocate funding, comply with the IRS, and follow Generally Accepted Accounting Principles (GAAP).

What if someone could handle these financial management tasks for you so you could focus on what’s really important? (Your mission!)

A nonprofit controller manages financial tasks so nonprofit professionals like you don’t have to. In this guide, we’ll help you learn all about this role by answering the following questions:

- What Is a Nonprofit Controller?

- What Does a Nonprofit Controller Do?

- What Are the Benefits of Hiring a Nonprofit Controller?

- What Challenges Do Nonprofit Controllers Manage?

- How Should My Organization Hire a Nonprofit Controller?

- Why Is YPTC the Best Choice for Nonprofit Controller Services?

What Is a Nonprofit Controller?

A nonprofit controller is an experienced financial professional who manages financial tasks for charitable organizations. From accounting to financial strategy to finance team leadership, they do the work of accountants and CFOs to provide a full range of financial services.

Nonprofit controllers help nonprofits remain financially transparent, healthy, and compliant with relevant laws and regulations. That way, nonprofit professionals can focus on fulfilling their missions and helping their beneficiaries.

What Does a Nonprofit Controller Do?

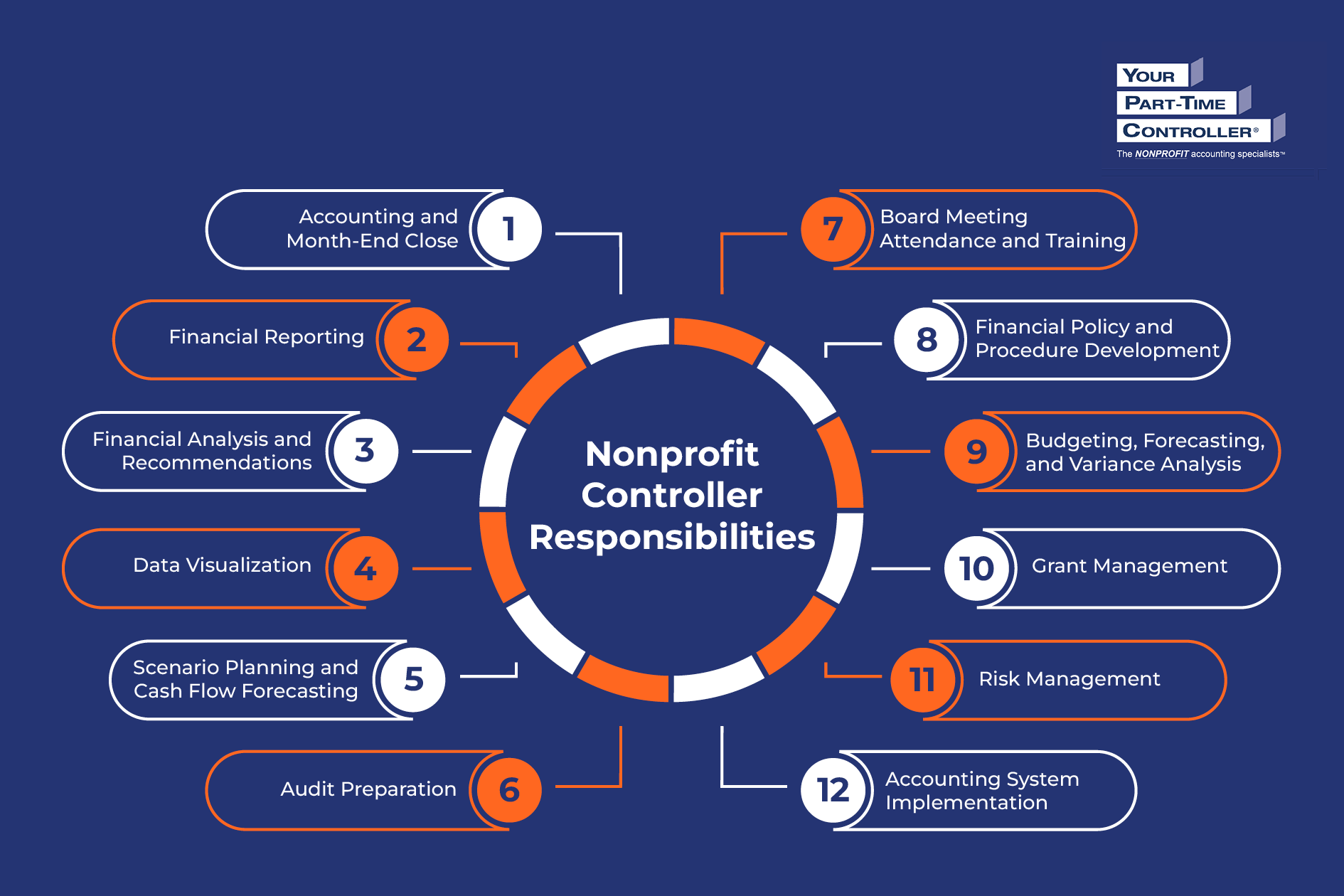

A nonprofit controller helps nonprofits through accounting and financial services like:

Accounting and Month-End Close

Nonprofit controllers perform accounting and bookkeeping work, such as:

- Reconciling accounts

- Allocating expenses

- Entering transaction data

- Maintaining organized financial records

- Processing payroll

By taking these day-to-day financial management tasks off your plate, nonprofit controllers help you focus on your mission.

Financial Reporting

To help you understand your nonprofit’s current financial position and remain compliant with GAAP, nonprofit controllers compile accurate financial reports, including:

- Statement of Financial Position, which provides information about your organization’s liquidity and financial flexibility

- Statement of Activities, which summarizes your revenue and expenses for a specific period of time

- Statement of Cash Flows, which reports on the cash flowing in and out of your organization over a certain period of time

- Statement of Functional Expenses, which categorizes your expenses based on their purposes

Financial Analysis & Recommendations

Using those financial reports, a nonprofit controller can help your team analyze and interpret the data. Then, they’ll communicate any strategy changes or recommendations you can make to improve your nonprofit’s financial position.

Data Visualization

A nonprofit controller will create and update relevant charts, graphs, and dashboards to make your financial data actionable. They’ll pinpoint your organization’s top key performance indicators (KPIs) and break down complex trends into a digestible format.

Scenario Planning and Cash Flow Forecasting

Whether federal funding is in flux, donations are low, or anything in between, uncertainty can greatly impact your nonprofit’s operations. By having your nonprofit controller plan for various scenarios and create regular cash flow reports, you can prepare for the unexpected and keep your organization financially stable.

Audit Preparation

Audits can be stressful, but nonprofit controllers can help ease some of that stress and prepare accordingly. They’ll assemble the necessary work papers, schedules, and financial documents, including:

- Financial statements

- Bank statements

- Investment statements

- Tax documents

- Fiscal policies

- General ledger

- Payroll records

- Donation and grant records

- Leases

- Vendor contracts

Additionally, your nonprofit controller will coordinate with your tax preparer to fill out your Form 990.

Board Meeting Attendance and Training

A nonprofit controller can attend board meetings to present financial reports and train your staff on financial best practices. It can be helpful to have a financial expert convey this information to ensure they cover all nuances of your nonprofit’s current situation.

Financial Policy and Procedure Development

Financial policies and procedures set the foundation for proper financial management. Your nonprofit controller can help you create the necessary policies, such as:

- Gift acceptance policy, which outlines your organization’s rules for accepting monetary and in-kind gifts

- Conflict of interest policy, which helps your nonprofit identify, manage, and mitigate potential conflicts of interest arising from key stakeholders’ outside financial interests or relationships

- Expense reimbursement policy, which outlines how you’ll reimburse stakeholders who incur work-related expenses on your organization’s behalf

- Fiscal policies and procedures, which include areas like internal controls, tax compliance and audits, budgeting and financial planning, financial reporting, and cash management

If your organization already has these policies in place, your nonprofit controller can strengthen your internal controls and update your procedures as necessary.

Budgeting, Forecasting, and Variance Analysis

Your budget is your nonprofit’s financial roadmap. To help you create an effective budget, your nonprofit controller can guide you through resource allocation, forecast future financial standing, and monitor budget performance.

Grant Management

Nonprofit controllers can handle incoming grants via the proper:

- Recording and classification

- Allocation methodologies

- Reporting requirements

- Requests for reimbursements

Risk Management

To protect your nonprofit’s financial sustainability, your nonprofit controller can help identify, assess, and mitigate potential financial risks. They’ll raise concerns about any vulnerabilities and help create a plan to address them.

Accounting System Implementation

The right accounting software can make all the difference in your financial management, provided you set it up correctly. A nonprofit controller can guide you through the buying, setup, and data migration processes to help you get the most out of your platform.

What Are the Benefits of Hiring a Nonprofit Controller?

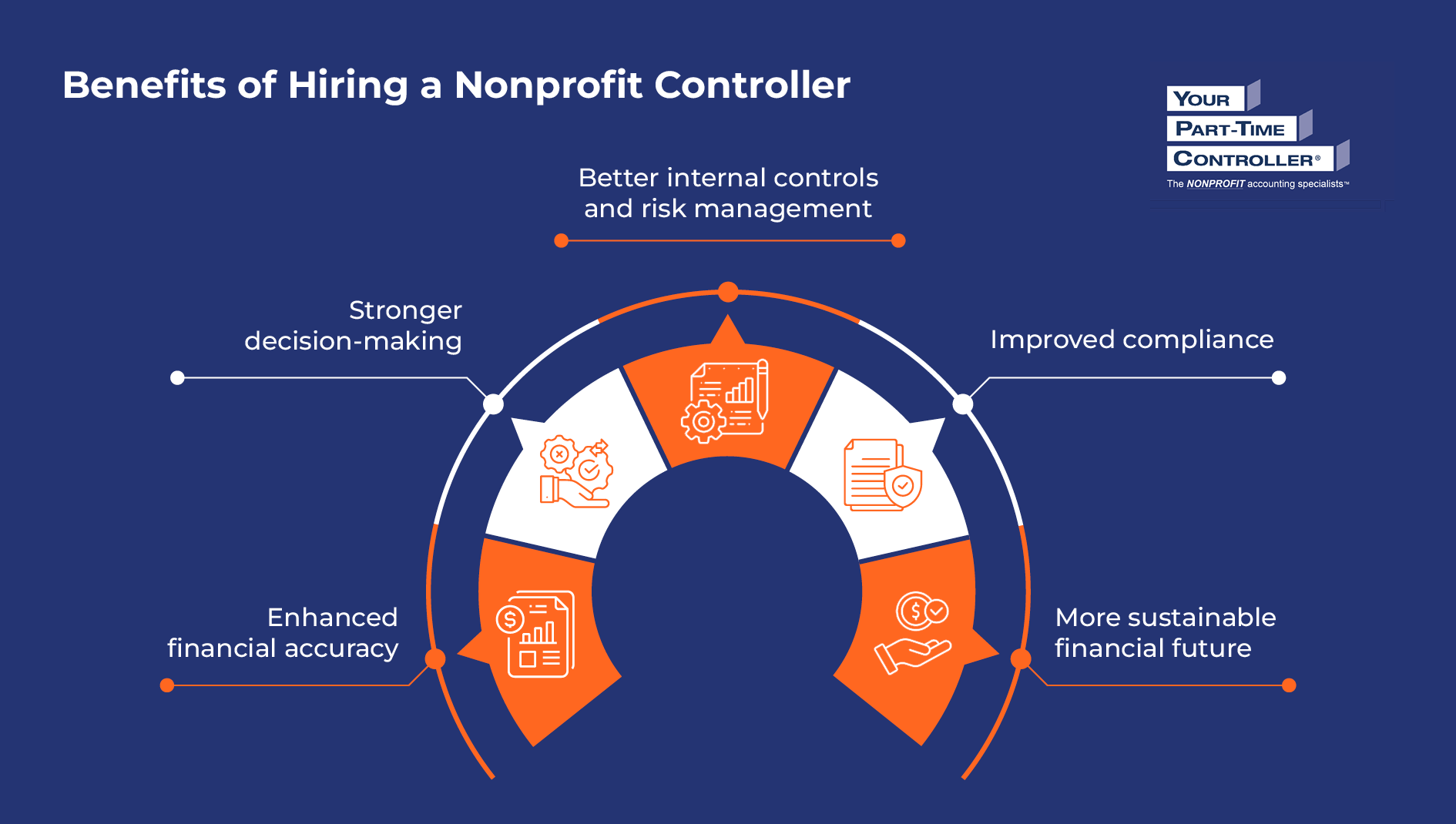

Nonprofit controllers can transform your financial management by taking over these responsibilities for you. As a result, they can provide the following benefits:

- Enhanced financial accuracy. With an expert on your side, you can be confident that your financial records are accurate and compliant with accounting standards and regulations. Nonprofit controllers minimize reporting errors and maximize donor confidence in your organization.

- Stronger decision-making. With more accurate financial data, you can make well-informed strategic decisions that fuel organizational growth and mission pursuit. Plus, a nonprofit controller can use their expertise to assist in critical financial decisions, helping you allocate resources appropriately.

- Better internal controls and risk management. Internal controls protect your nonprofit’s financial assets and prevent fraud and fund misuse. A nonprofit controller will fortify your internal controls to manage impending risks effectively.

- Improved compliance. From following GAAP to preparing for audits, nonprofit controllers assist your organization in staying compliant with all relevant regulations every step of the way. Additionally, they’ll help you adhere to funding restrictions to stay accountable to stakeholders.

- More sustainable financial future. Nonprofit controllers go beyond the here and now of your nonprofit’s finances to focus on longevity. Between scenario planning, cash flow forecasting, revenue diversification, investing, and reserve fund building, nonprofit controllers provide guidance to help ensure your finances are sustainable to power your mission for the long haul.

By carefully handling your organization’s financial management, a nonprofit controller can strengthen your financial strategy, improve donor relationships, and set your organization up for continued success.

What Challenges Do Nonprofit Controllers Manage?

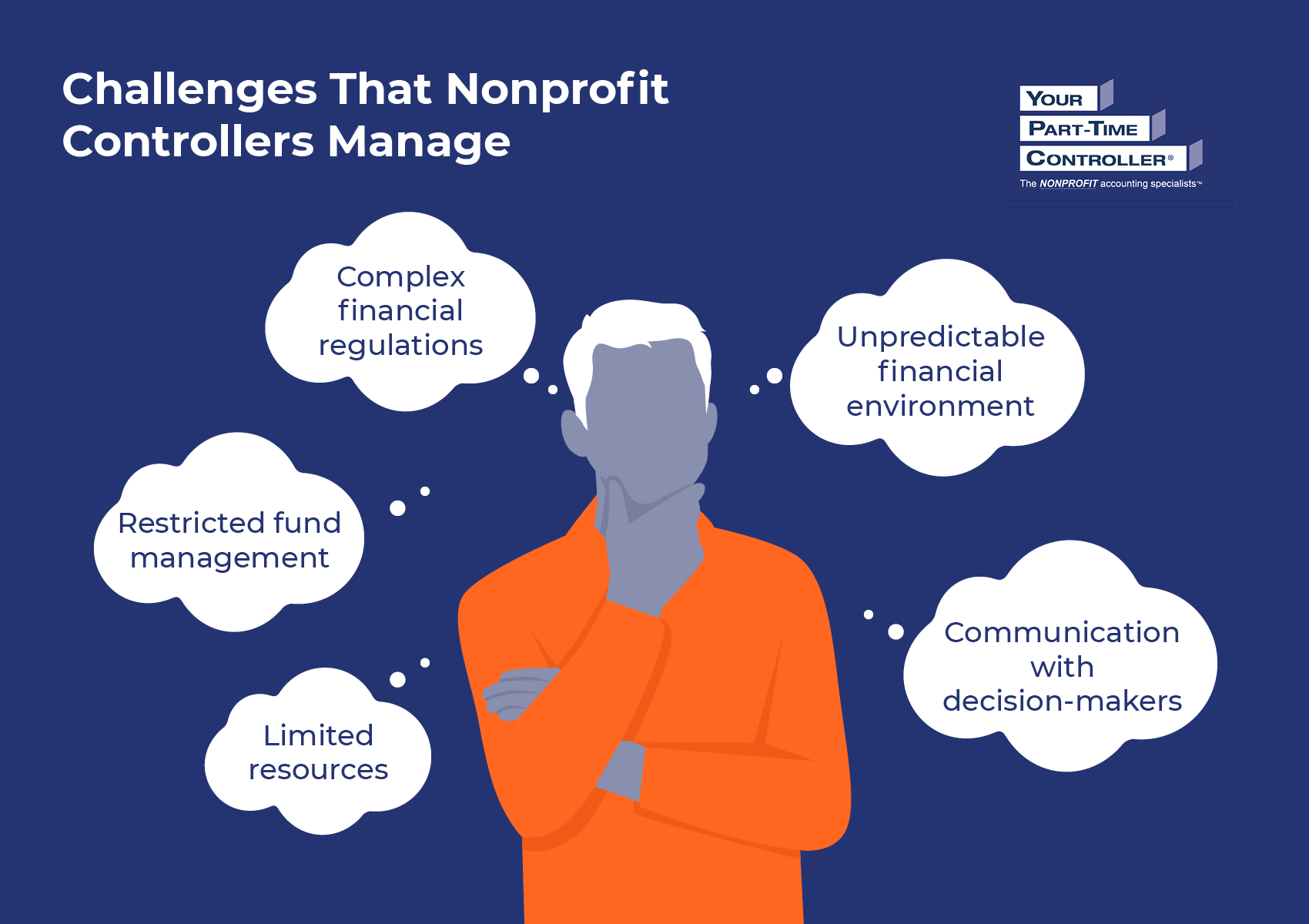

Nonprofit financial management is complex and nuanced. When you hire a nonprofit controller, you’re not just gaining a team member who will manage your finances. Instead, you’re unlocking access to a subject matter expert who can simultaneously balance several financial management challenges.

The obstacles nonprofit controllers help your organization overcome include:

- Limited resources. Since nonprofits operate with limited budgets, nonprofit controllers must be highly strategic about allocating resources. While a nonprofit controller is a wise investment to optimize your resources, it also means that one person must take on several different roles that a for-profit organization would typically split across various team members. As a result, nonprofit controllers must be adept at streamlining financial tasks, often leveraging technology and automation to help.

- Restricted fund management. Your organization likely receives restricted funds you must set aside for particular purposes or specific time frames. These stipulations can complicate accounting and reporting. A nonprofit controller must track these funds carefully to ensure your nonprofit uses them according to donors’ wishes.

- Complex financial regulations. To maintain tax-exempt status, nonprofits must adhere to strict IRS guidelines. They must also comply with accounting rules, state and local tax laws, and grant reporting requirements. Nonprofit controllers must follow these regulations while keeping your organization financially stable and sustainable.

- Unpredictable financial environment. Since nonprofits depend heavily on donations and federal funding, any fluctuations in economic circumstances and policies can impact how charitable organizations operate. A nonprofit controller has to navigate this uncertainty and find ways to sustain your organization’s finances even when cash flow is more limited.

- Communication with decision-makers. Not every member of your nonprofit’s team has the same level of financial knowledge. It’s the nonprofit controller’s job to present financial information in a clear, digestible way while still conveying the nuances necessary for key stakeholders to understand for informed decision-making.

While your nonprofit can certainly surmount challenges like navigating the federal funding process on its own, it will take away significant time and energy from your mission. Working with a nonprofit controller allows you to focus on what truly matters and leave the complexities of nonprofit financial management to an expert.

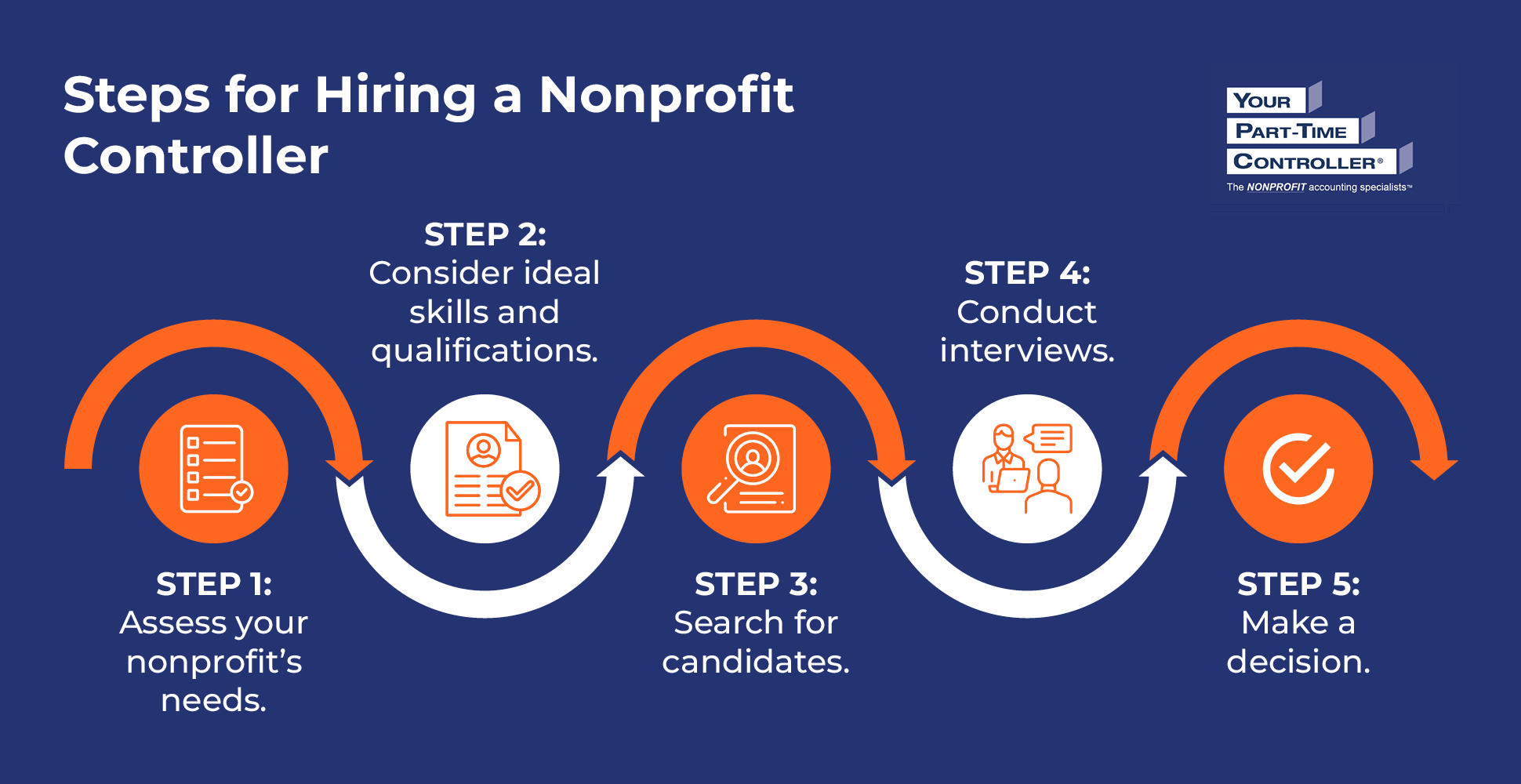

How Should My Organization Hire a Nonprofit Controller?

Hiring a nonprofit controller is an investment. Therefore, you should be meticulous in your hiring process to find the right candidate for your organization. Follow these steps to select the best controller:

1. Assess your nonprofit’s needs.

When you hire any new team member, you’re fulfilling a need within your organization. Taking the time to clarify that need ensures you hire a candidate with relevant experience and can be upfront with them during the hiring process.

Start by evaluating your nonprofit’s current financial situation. You may answer questions like:

- How many revenue streams do we currently have?

- What types of restricted funds do we manage?

- What area do we need the most assistance with?

- Are there any responsibilities we’d like to keep within a current team member’s role?

Let’s say you run a large nonprofit with several revenue streams and a robust finance team. You may need to hire a nonprofit controller to optimize your internal controls and help you plan for your organization’s financial future while keeping day-to-day accounting and bookkeeping responsibilities under your current staff. Your needs in a nonprofit controller may look quite different from those of a small nonprofit that needs a controller to handle all aspects of its financial management.

2. Consider ideal skills and qualifications.

Next, determine the skills and qualifications your ideal candidate will possess. This step will help you refine your job description and postings to receive more qualified applicants. For example, you may request that applicants have the following qualifications:

- A Bachelor’s degree in accounting or finance

- Certified Public Accountant (CPA) license preferred

- At least five years of working in accounting, preferably with a nonprofit

- Strong analytical and communication skills

- Close attention to detail

- Experience in nonprofit financial regulations, accounting principles, and reporting standards

Your team may adjust these qualifications based on the needs you previously identified. For example, if you’re looking for a controller who has experience with cash flow forecasting and investing, state that here.

Additionally, you may mark some qualifications as preferences rather than requirements. This minor change can expand your hiring pool and encourage candidates with valuable experience to apply. For instance, a strong candidate with only three years of experience as an accountant may be suitable, especially if they’ve worked closely with a nonprofit similar to yours.

3. Search for candidates.

Now, it’s time to actively look for candidates. Besides posting your job description on your nonprofit’s website, take these steps to spread the word about your open role more broadly:

- Share the job listing across platforms. Use traditional job boards like LinkedIn and Indeed to expand your job listing’s reach. You may also use nonprofit-specific job boards like Idealist and The Chronicle of Philanthropy, and leverage online nonprofit networking groups to attract more like-minded candidates.

- Request recommendations from your network. Ask other nonprofits if they’ve used a controller and had a positive experience with them. If your organization is part of a broader association, consider contacting other members for industry-specific recommendations or calling upon your board members.

- Perform direct outreach. While it can be tedious, direct outreach can grab qualified candidates’ interest and encourage them to apply. If you have the time, have a team member source candidates from LinkedIn and other professional networking sites and reach out to them accordingly.

- Consider fractional service providers. For many nonprofits, fractional CFO, controller, or accounting services provide an ideal solution. Outsourced accounting benefits include cost savings, flexibility, access to specialized expertise, additional support and training, and more.

If your nonprofit already has a recruiter, you can use that resource to streamline the hiring process and relieve other staff members of these tasks.

4. Conduct interviews.

Once you’ve reviewed applications, scheduling and conducting interviews is the next step. Ask questions relevant to the role that allow candidates to show their experience, such as:

- How would you rectify a situation in which donor-restricted funds were misused?

- What has been your approach to managing finances for a nonprofit with diverse revenue streams?

- How would you best set up our organization for continued financial success?

Additionally, assess each candidate’s cultural fit with your organization. Evaluate their communication skills, alignment with your mission, and personalities to determine which applicants would mesh well with your team.

5. Make a decision.

Lastly, sit down with your team to review top candidates and finalize your decision. Consider the various factors that make someone suitable for the position, and weigh the pros and cons of each applicant.

Then, extend an offer to your new controller and kick off the onboarding and training processes!

Why Is YPTC the Best Choice for Nonprofit Controller Services?

While your organization may need to hire a nonprofit controller, you may not have the resources to go through the traditional hiring process or compensate a full-time team member. YPTC is the ideal choice for outsourced nonprofit controller services.

By outsourcing your organization’s controller work to our nonprofit accounting firm, you’ll receive affordable, professional nonprofit controller services that meet your needs. Our firm stands out due to our:

- Nonprofit expertise. We’ve worked with nonprofit executive directors and board members for over three decades, allowing them to lean on us for the financials and focus their energy on their missions. From foundations to animal welfare organizations to independent schools, we work with nonprofits of all different types to strengthen their finance functions.

- Flexible, fractional services. We’re happy to work as your nonprofit controller, handling all your nonprofit financial management needs. Or, we can serve as your bookkeeper, accountant, or fractional CFO. Our services are flexible and customizable to your nonprofit’s needs.

- Assistance from anywhere. Whether you prefer to work with our controllers face-to-face, remotely, or a combination of the two, we offer professional nonprofit accounting and financial management services from anywhere.

Curious to hear about how real nonprofits have found success by partnering with YPTC? Check out these testimonials from a few of our clients:

- “When we switched property management companies mid-year, YPTC assisted with the transition on the accounting side. It was very difficult for us to find a Controller with the required knowledge for our complex organization, and YPTC was able to fill that gap.” – Kristen Andreazza, Chief Financial Officer, Settlement Housing Fund

- “I turned to YPTC and they have truly been a game changer for our relatively small nonprofit. To have all of their expertise from the controller level to staff accountant, and then having access to the breadth of support and knowledge from all the other nonprofits they work with, has been incredible.” – Eva Thibaudeau, Chief Executive Officer, Temenos CDC

- “We think of Ray as a team member and invite him to holiday parties. It’s not just the work that he does for us as our controller, it’s also how he helps other people on our staff grow. It’s above and beyond what you normally think a controller should be.” – Lauren Bivona, Executive Director, SAFE in Hunterdon

If you’re ready to start leveraging our nonprofit controller services, contact us today so we can learn more about your organization and discuss our services. To learn more about nonprofit financial management, check out these resources:

- Nonprofit Accounting: What Charitable Orgs Need to Know. Learn the basics of nonprofit accounting, including how it differs from for-profit accounting, the type of nonprofit financial statements, and best practices.

- Top Nonprofit Audit Preparation Guide: What You Need to Know. Explore how your organization can best prepare for an upcoming audit to ease stress and ensure compliance.

- What Is a Fractional CFO? Your Nonprofit Questions Answered. A fractional CFO provides part-time financial services and expertise. Check out this guide to learn more about the role and whether your nonprofit should hire one.

Jennifer Alleva

Jennifer Alleva is the Chief Executive Officer at Your Part-Time Controller, LLC (YPTC), a leading provider of nonprofit accounting services, #65 on Accounting Today’s list of Top 100 accounting firms and the #1 Best Firm to Work For by Accounting Today. Jennifer brings over three decades of expertise in accounting and leadership to her role as CEO of YPTC.

When Jennifer joined YPTC in 2003, the firm consisted of just over 10 staff members. Since then, she has helped grow YPTC into one of the fastest-growing accounting firms in the country.

Jennifer’s accomplishments include her tenure as an adjunct professor at the University of Pennsylvania Fels Institute, her frequent speaking engagements on nonprofit financial management issues, her role as the founder of the Women in Nonprofit Leadership Conference in Philadelphia, and her launch of the Mission Business Podcast in 2021, which spotlights professionals and narratives from the nonprofit sector.