Nonprofit Cash Flow Statement: FAQs and How to Interpret It

Financial health is more than just your revenue and expenses. The amount of cash your organization has at any given time also determines how well your nonprofit can operate and fulfill its mission.

However, many charitable organizations struggle with cash flow. Nonprofit Finance Fund’s 2025 State of the Nonprofit Sector Survey found that:

- 38% of nonprofits have experienced delays in government funding that impacted cash flow.

- 36% of nonprofits ended 2024 with an operating deficit.

- 52% of nonprofits have three months or less of cash on hand.

- 18% of nonprofits have one month or less of cash on hand.

While some external circumstances, like limited federal funding, are out of your nonprofit’s control, you can practice proper cash flow management to set your organization up for success. By compiling a comprehensive nonprofit cash flow statement and interpreting it effectively, you can better understand your nonprofit’s financial standing and make well-informed decisions. In this guide, we’ll cover everything you need to know about nonprofit cash flow statements, including:

- Nonprofit Cash Flow Statement FAQs

- Common Mistakes Organizations Make When Compiling a Nonprofit Cash Flow Statement

- How to Interpret Your Nonprofit Statement of Cash Flows

Nonprofit Cash Flow Statement FAQs

Nonprofit Cash Flow Statement FAQs

What Is a Nonprofit Cash Flow Statement?

A nonprofit cash flow statement reports on the cash flowing in and out of your organization over a period of time. It’s one of the three financial statements required under Generally Accepted Accounting Principles (GAAP), along with a nonprofit Statement of Financial Position and a nonprofit Statement of Activities. Like the for-profit version of this document, a nonprofit Statement of Cash Flows classifies cash inflows and outflows as operating, investing, or financing activities.

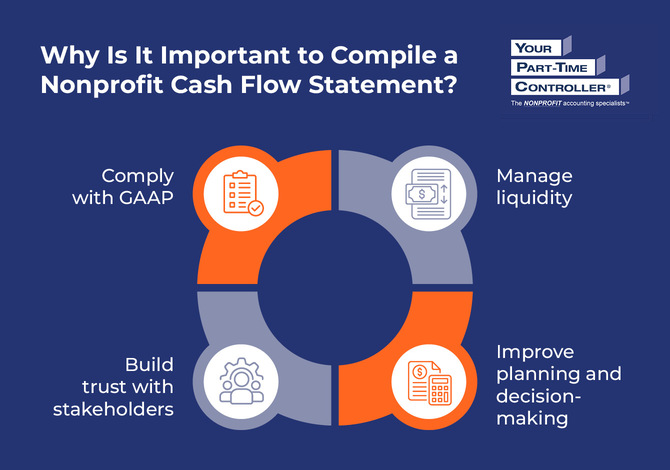

Why Is It Important to Compile a Nonprofit Cash Flow Statement?

In addition to complying with GAAP, a nonprofit cash flow statement allows your organization to:

- Manage liquidity. Liquidity is a measure of financial health, flexibility, and the ability to pay current bills and operating expenses. While your Statement of Activities may indicate a surplus of income due to accruals like pledges receivable, you won’t be able to support your nonprofit’s operations if cash isn’t actually flowing in. By showing how cash moves in and out of your organization, a Statement of Cash Flows can help you spot and address future cash shortages before they happen.

- Improve planning and decision-making. When you understand your organization’s cash flow, you can make more proactive, informed financial decisions that keep your nonprofit sustainable. For example, a cash flow statement helps you see whether your organization actually has the cash available to purchase new assets, like office equipment or vehicles, rather than just relying on the amount you’ve allocated in your budget. Additionally, if you find that you have consistent excess cash, you can invest those funds to grow their value.

- Build trust with stakeholders. Sharing your nonprofit cash flow statement with donors gives them more insight into your financial management practices and can boost your credibility. This document also provides context for board members’ decisions and allows grantors to assess your nonprofit’s financial stability.

When you carefully compile your nonprofit cash flow statement, you give everyone involved in your organization a better understanding of your nonprofit’s current financial position.

What Is the Difference Between a Statement of Cash Flows and the Other Financial Statements?

While a nonprofit cash flow statement demonstrates the cash flowing in and out of your organization, the other financial statements required under GAAP have slightly different purposes:

- The nonprofit Statement of Financial Position (also known as a balance sheet) reports on your organization’s assets, liabilities, and net assets as of a specific date. Like the nonprofit Statement of Cash Flows, this document reveals information about your organization’s financial health and liquidity, but instead of showing cash inflows and outflows over a period of time, it provides a snapshot of your resources as of a specific point in time.

- The nonprofit Statement of Activities (also known as an income statement) reports on your nonprofit’s revenues, expenses, and change in net assets over a specific period on an accrual basis (revenue when earned, expenses when incurred). Your cash flow statement, on the other hand, reports your activity on a cash basis over a specific period.

In addition to the three main financial statements, nonprofits may also compile a nonprofit Statement of Functional Expenses to report on the nature and functional purpose (program, administrative, or fundraising) of their expenses. This document prepares you to report your expenses on Form 990 and remain transparent about your resource allocation to internal and external stakeholders.

What Information Does a Nonprofit Statement of Cash Flows Include?

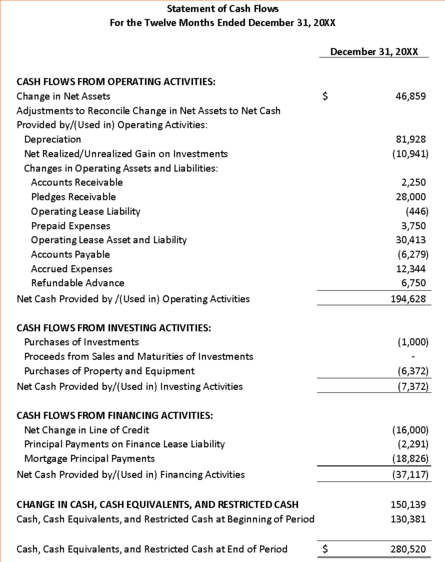

A nonprofit Statement of Cash Flows includes the following categories:

- Cash Flows from Operating Activities. Operating activities encompass the day-to-day functions your nonprofit performs. Cash inflows from operating activities may include funds from donations, program fees, grants, and membership dues. Cash outflows from operating activities may look like staff salaries and wages, fundraising costs, utilities, supplies, and rent.

- Cash Flows from Investing Activities. Investing activities are associated with long-term asset management. Proceeds from selling fixed assets and investment maturities are cash inflows from investing activities. Investment, property, and equipment purchases are investing cash outflows.

- Cash Flows from Financing Activities. Financing activities relate mostly to long-term liability management, such as borrowing funds and repaying debts. Cash inflows from financing activities may include lines of credit and loan proceeds, while cash outflows would include any debt payments, like mortgage payments.

- Change in Cash, Cash Equivalents, and Restricted Cash. To assess how your cash flows have changed over time, you’ll report the cash, cash equivalents, and restricted cash at the beginning and end of the designated period. This section should appear at the bottom of your statement.

Check out this example of a nonprofit Statement of Cash Flows:

Common Mistakes Organizations Make When Compiling a Nonprofit Cash Flow Statement

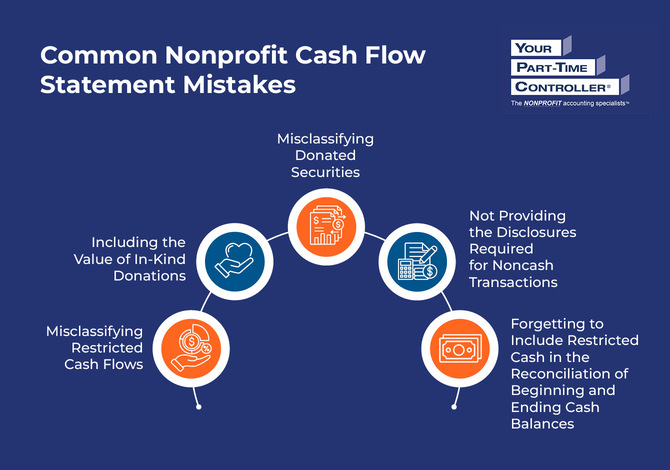

Compiling a nonprofit cash flow statement can be a complex process. Here are some common mistakes to avoid:

Misclassifying Restricted Cash Flows

While many for-profit organizations can lump all their revenue together, nonprofits need to classify funds based on donor-imposed restrictions.

Here’s how you’ll categorize different types of restricted cash flows:

- Operating Activities. All inflows from donations and investment income that are not restricted for long-term purposes go under Operating Activities.

- Financing Activities. Inflows from permanently restricted endowment contributions go under Financing Activities. Additionally, donations restricted for long-term asset acquisition, such as capital campaign funds for a new building, are also Financing Activities.

- Investing Activities. Outflows from investing endowment funds and inflows from endowment investment returns are reported as Investing Activities.

Note that accounting for endowment cash flows spans all three categories. Remember to consider the nature of each inflow and outflow carefully to ensure proper classification.

Additionally, transfers between cash/cash equivalents and restricted cash/cash equivalents are not reported as cash flow activities in the Statement of Cash Flows. (More on restricted cash later.)

Including the Value of In-Kind Donations

Including the Value of In-Kind Donations

When you receive an in-kind donation, you’ll determine its fair market value (FMV) and record it as both a revenue and an expense. Even though you attach a monetary value to the in-kind contribution, you aren’t receiving cash, so you won’t record it as a cash inflow.

Depending on the method you use to prepare your Statement of Cash Flows, you will exclude or remove the value of any in-kind donations from your Operating Activities category.

Misclassifying Donated Securities

Many nonprofits receive gifts of securities (e.g., stocks, bonds). They may choose to hold those assets or liquidate them and use the proceeds according to the donor’s intent, and they may make this choice on a case-by-case basis or as a matter of policy. Transactions involving securities are often assumed to be investing activities, but there is an important exception in GAAP that nonprofits need to be aware of.

If you hold donated securities and later sell them, then the proceeds would be classified as an investing activity.

However, if you have a policy requiring immediate liquidation (i.e., within a matter of days) of securities upon receipt, meaning no discretionary decision is made, then the cash proceeds from the sale should be classified as operating activities—unless the donor restricted the resource for a long-term purpose, in which case they would be classified as financing activities.

Not Providing the Disclosures Required for Noncash Transactions

Noncash investing and financing activities are excluded from the respective areas of the Statement of Cash Flows but must be separately disclosed in either a narrative or schedule format on the face of the Statement of Cash Flows or in the notes to the financial statements.

Here are some common examples of noncash investing and financing transactions:

- Acquisition of a Fixed Asset with a Lease

- Purchase of a Building or Investment with a Gift or Seller Financing

- Reinvested Dividends/Interest

For transactions that are part cash and part noncash, report only the cash portion on the Statement of Cash Flows.

Forgetting to Include Restricted Cash in the Reconciliation of Beginning and Ending Cash Balances

GAAP requires nonprofits to explain the change in total cash, cash equivalents, and restricted cash over the period. When this total is presented in more than one item on the Statement of Financial Position, those same line items must be presented on the Statement of Cash Flows or in the notes to the financial statements. Note that GAAP does not define restricted cash, so nonprofits need to disclose how they define it.

How to Interpret Your Nonprofit Statement of Cash Flows

Positive cash flow may be the first thing you look for on the Statement of Cash Flows to confirm your organization has enough cash to fund its operations and pay off short-term obligations. However, negative cash flow may actually be preferable in some instances, depending on which section of your nonprofit’s cash flow statement you’re looking at.

Let’s review each main category of the nonprofit Statement of Cash Flows and what different results mean for your organization:

Operating Activities

Positive cash flow in this area indicates you’re generating enough funding from sources like donations, program fees, grants, and membership dues to cover costs like staff salaries and wages, utilities, supplies, and rent. You’ll want this number to grow or at least become stable over time.

Negative cash flow from operating activities means your core activities expend more cash than they generate. To keep your organization afloat, you’ll likely need to sell assets, borrow funds, or access your reserves, which may not be sustainable long-term.

Investing Activities

In this category, negative cash flow can be a good indicator that you’re investing in your organization’s future. Think about it—money flowing out to purchase investments, property, and equipment means you’re thinking ahead and using funds to keep your mission alive for years to come.

You may also have positive cash flow from strategic asset sales or investment income, which can signify a healthy financial position.

On the other hand, if you only have positive investing cash flow from liquidating your investments or selling essential equipment to free up cash needed for basic operations, you may be heading toward insolvency.

Financing Activities

Cash flowing out for loan payments can indicate that you’re paying down your debt to get your organization into a healthier financial position.

However, if you consistently have cash flowing in from a line of credit, you might be relying too heavily on borrowed funds. Ideally, large inflows from loan proceeds should be paired with asset purchases in your cash outflows from investing activities.

Additional Nonprofit Financial Statement Resources

The nonprofit cash flow statement is a key component of GAAP compliance and financial decision-making. With an in-depth view of your organization’s liquidity, you can better plan for the future and build trust with stakeholders.

While compiling this statement can be complex, you don’t have to handle it alone. The nonprofit financial management experts at YPTC are ready to help you prepare and analyze all of your nonprofit financial statements. Contact us today to get started.

If you’d like to learn more about nonprofit financial statements, check out the following resources:

- Demystifying the 4 Main Nonprofit Financial Statements. In this guide, peruse an overview of the main nonprofit financial statements and why they’re important.

- What Is a Nonprofit Balance Sheet? Breaking Down This Report. Dive deeper into the nonprofit balance sheet to discover the nuances of this statement and how to interpret it.

- Top Nonprofit Audit Preparation Guide: What You Need to Know. A financial statement audit verifies that your statements are accurate, complete, and GAAP-compliant. Learn more about what a financial audit entails.

Jennifer Alleva

Jennifer Alleva is the Chief Executive Officer at Your Part-Time Controller, LLC (YPTC), a leading provider of nonprofit accounting services and #65 on Accounting Today’s list of Top 100 accounting firms. Jennifer brings over three decades of expertise in accounting and leadership to her role as CEO of YPTC.

When Jennifer joined YPTC in 2003, the firm consisted of just over 10 staff members. Since then, she has helped grow YPTC into one of the fastest-growing accounting firms in the country.

Jennifer’s accomplishments include her tenure as an adjunct professor at the University of Pennsylvania Fels Institute, her frequent speaking engagements on nonprofit financial management issues, her role as the founder of the Women in Nonprofit Leadership Conference in Philadelphia, and her launch of the Mission Business Podcast in 2021, which spotlights professionals and narratives from the nonprofit sector.